It’s easy to fall into the trap of buying things we don’t actually need, from trendy gadgets to impulse purchases.

Unnecessary expenses can quickly add up and strain our finances. By identifying items that we can do without, we can save money and prioritize spending on things that truly matter.

Here are 15 items you don’t need and can save your money on, helping you to make more mindful and intentional choices with your finances.

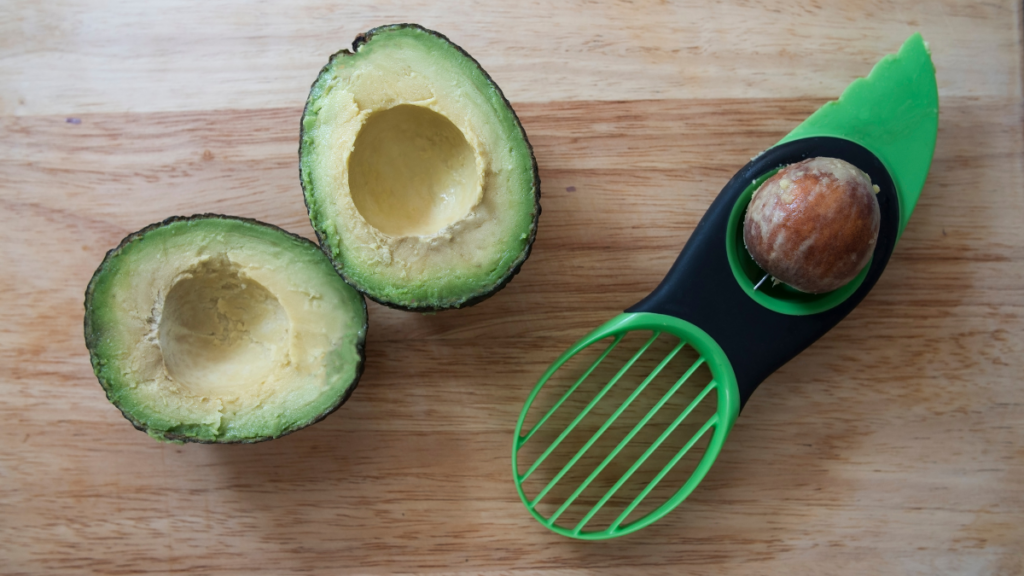

Single-Use Kitchen Gadgets

Single-use kitchen gadgets, such as avocado slicers or garlic presses, may seem convenient, but they end up collecting dust in the back of your drawers. Instead of purchasing specialized tools for specific tasks, choose multi-purpose kitchen essentials that can perform various functions, saving both money and storage space.

Brand-Name Cleaning Products

Brand-name cleaning products may promise superior performance, but you can achieve the same results with budget-friendly alternatives.

Generic or store-brand cleaning products often contain similar active ingredients at a fraction of the cost. Save money by choosing these more affordable options without sacrificing cleanliness.

Cable TV Subscriptions

With the use of streaming services, cable TV subscriptions have become increasingly obsolete.

Instead of paying for many channels you rarely watch, consider cutting the cord and subscribing to streaming platforms that offer on-demand content at a lower cost.

You can customize your viewing experience and save money by only paying for the content you actually want to watch.

Excessive Clothing

Trends come and go, but a wardrobe filled with excessive clothing can lead to clutter and overspending.

Before making a new clothing purchase, evaluate whether it fills a gap in your wardrobe and aligns with your personal style.

Investing in timeless, versatile pieces that can be mixed and matched will save you money in the long run.

Bottled Water

Purchasing bottled water is not only costly but also environmentally unsustainable. Invest in a reusable water bottle and fill it with filtered water, which is just as safe and often subject to stricter regulations than bottled water.

You’ll save money by cutting out single-use plastic bottles while reducing your environmental footprint.

Designer Handbags

Designer handbags may be coveted status symbols, but they come with hefty price tags that can strain your budget. Instead of splurging on luxury brands, choose high-quality, well-made handbags from more affordable retailers.

Focus on timeless designs that will stand the test of time rather than chasing fleeting trends.

Extended Warranties

Extended warranties may seem like a good investment to protect your purchases, but they often provide minimal additional coverage and come with hidden fees.

Most products are already covered by manufacturer warranties or consumer protection laws, making extended warranties unnecessary.

Save money by skipping these costly add-ons and putting it towards more essential expenses.

Fancy Coffee Drinks

Frequenting coffee shops for fancy espresso drinks can quickly drain your bank account. Invest in a high-quality coffee maker and brew your favorite beverages at home for a fraction of the cost.

You can customize your drinks to your exact preferences and enjoy them without the markup of a café.

Brand-Name Medications

Despite containing the same active ingredients, brand-name medications are often significantly more expensive than their generic counterparts.

Save money on prescription and over-the-counter medications by choosing generic versions whenever possible.

The FDA regulates these alternatives and requires rigorous testing to ensure safety and efficacy.

Unused Gym Memberships

Gym memberships can be costly, especially if you don’t use them regularly. Instead of committing to a long-term contract, explore alternative fitness options such as outdoor activities, home workouts, or pay-as-you-go fitness classes.

Find activities that you enjoy and are more likely to stick with, saving you money in the long term.

Fast Fashion

Fast fashion may offer trendy styles at low prices but comes with ethical and environmental costs. Instead of constantly buying cheap clothing that falls apart after a few wears, invest in quality pieces from sustainable brands or thrift stores.

Unused Subscriptions

Subscription services for magazines, streaming platforms, or meal kits can quickly accumulate and drain your bank account if left unused.

Regularly review your subscriptions and cancel any that you no longer need or use.

Trimming unnecessary subscriptions will free up money for expenses that provide more value and enjoyment.

Expensive Phone Plans

Many people overpay for phone plans with more data and features than they actually need. Evaluate your usage patterns and opt for a more budget-friendly plan that aligns with your needs.

Consider switching to a prepaid or discount carrier for even greater savings without sacrificing coverage or quality.

Excessive Home Decor

Decorating your home can be fun, but it’s easy to overspend on unnecessary décor items that clutter your space. Instead of constantly buying new decorations, focus on curating a few meaningful pieces that reflect your personality and style.

DIY projects and upcycled furnishings can also add character to your home without breaking the bank.

Expensive Dining Out

Dining out at fancy restaurants can be costly and add up over time. Instead of splurging on expensive meals, choose homemade dinners or more affordable dining options such as food trucks or casual eateries.

You can still enjoy delicious food and socializing with friends without overspending on restaurant bills.

15 Things From The 90s That Are a Big No-No Now

The 1990s were a decade filled with iconic trends and cultural phenomena that shaped a generation. However, looking back, several aspects of that era are now…

15 Things From The 90s That Are a Big No-No Now

15 Basic Hygiene Routines Most People Fail To Do

Maintaining proper hygiene is essential for overall health and well-being. However, some basic hygiene routines often get overlooked in our daily lives. In this article, we’ll…

15 Basic Hygiene Routines Most People Fail To Do

16 Nostalgic Items from the Boomer Era That Deserve a Comeback Immediately

As Baby Boomers, born from 1946 to 1964, advance in years, we witness the gradual waning of numerous cultural, economic, and social trends. Boomers have greatly…

16 Nostalgic Items from the Boomer Era That Deserve a Comeback Immediately

15 Common Behaviors That Show Someone’s True Colors

Understanding someone’s true character can be challenging, as people often present themselves differently in various situations. However, certain behaviors can offer insights into a person’s genuine…

15 Common Behaviors That Show Someone’s True Colors

15 Signs You’re In The Lower Class

Navigating socioeconomic status can be complex, but certain indicators may suggest that you’re part of the lower class. Understanding these signs can provide insight into financial…

15 Signs You’re In The Lower Class

Victoria Cornell helps women adopt a positive mindset even when the struggles of motherhood feel overwhelming. Victoria writes for multiple media outlets where she writes about, saving money, retirement, ways to reduce stress with mindset, manifesting, goal planning, productivity, and more.