Building wealth isn’t just about earning a high income; it’s also about managing money wisely. The rich often adhere to simple yet effective financial rules that guide their decisions and behaviors. These rules aren’t secrets but accessible to anyone willing to implement them.

Here are 15 simple rules the rich follow with their money, which can serve as valuable guidelines for financial success.

Spend Less Than You Earn

One of the fundamental principles of wealth accumulation is living below your means. The rich prioritize saving and investing a portion of their income rather than succumbing to lifestyle inflation.

Pay Yourself First

The rich prioritize setting aside a portion of their income for savings and investments before paying bills or making discretionary purchases. This ensures that they consistently build wealth over time.

Invest Wisely

The rich understand the power of investing and make informed decisions about where to allocate their money. They diversify their investment portfolios, focusing on long-term growth rather than short-term gains.

Avoid Debt

While debt can be a tool when used strategically, the rich are cautious about taking on excessive debt that could hinder their financial freedom. They prioritize paying off high-interest debt and avoid unnecessary borrowing.

Have Multiple Income Streams

Instead of relying solely on a single source of income, the rich often diversify their earnings through investments, side businesses, rental properties, and other passive income streams.

Set Clear Financial Goals

The rich establish specific, measurable, and achievable financial goals to guide their wealth-building efforts. Whether it’s saving for retirement, buying a home, or starting a business, having clear objectives helps them stay focused and motivated.

Prioritize Education and Self-Improvement

Continuous learning is key to financial success. The rich invest in their education and skills development through formal education, workshops, seminars, or self-study to stay informed and adaptable in a rapidly changing world.

Automate Savings and Investments

The rich automate their savings and investment contributions to ensure consistency and discipline in their financial habits. This removes the temptation to spend impulsively and helps them build wealth steadily over time.

Practice Frugality Where It Matters

While the rich may enjoy the fruits of their labor, they also recognize the value of frugality. They prioritize spending on experiences and assets that provide long-term value while cutting back on non-essential expenses.

Network and Build Relationships

Networking isn’t just about socializing; it’s also about cultivating valuable connections that can lead to new opportunities and insights. The rich prioritize building strong relationships with mentors, peers, and industry leaders to expand their knowledge and opportunities.

Embrace Risk, But Manage It

Successful wealth-building often involves taking calculated risks in business ventures or investment opportunities. However, the rich also understand the importance of risk management strategies to protect their assets and mitigate potential losses.

Plan for Taxes

Taxes are a significant expense for the wealthy, so they take proactive steps to minimize their tax liabilities through strategic planning, deductions, and compliance with tax laws.

Live Within Your Means

Even as their wealth grows, the rich remain mindful of their expenses and avoid unnecessary extravagance. They understand that living beyond their means can erode their financial stability over time.

Give Back

Philanthropy is a cornerstone of wealth management for many affluent individuals. The rich prioritize giving back to their communities through charitable donations, volunteering, and supporting causes they believe in.

Stay Disciplined and Patient

Building wealth is a marathon, not a sprint. The rich exhibit discipline and patience in their financial decisions, staying focused on their long-term goals despite short-term challenges or market fluctuations.

15 Things So Expensive People Are Now Making Do Without

Today’s economy is harsh! The cost of living continues to soar, rendering once-commonplace items unaffordable luxuries for many. From everyday necessities to small indulgences, some simple…

15 Things So Expensive People Are Now Making Do Without

The 15 Hardest Parts of Growing Old That Everyone Refuses to Talk About

Growing old is a natural part of life, but it comes with its own set of challenges that aren’t always openly discussed. From physical ailments to…

The 15 Hardest Parts of Growing Old That Everyone Refuses to Talk About

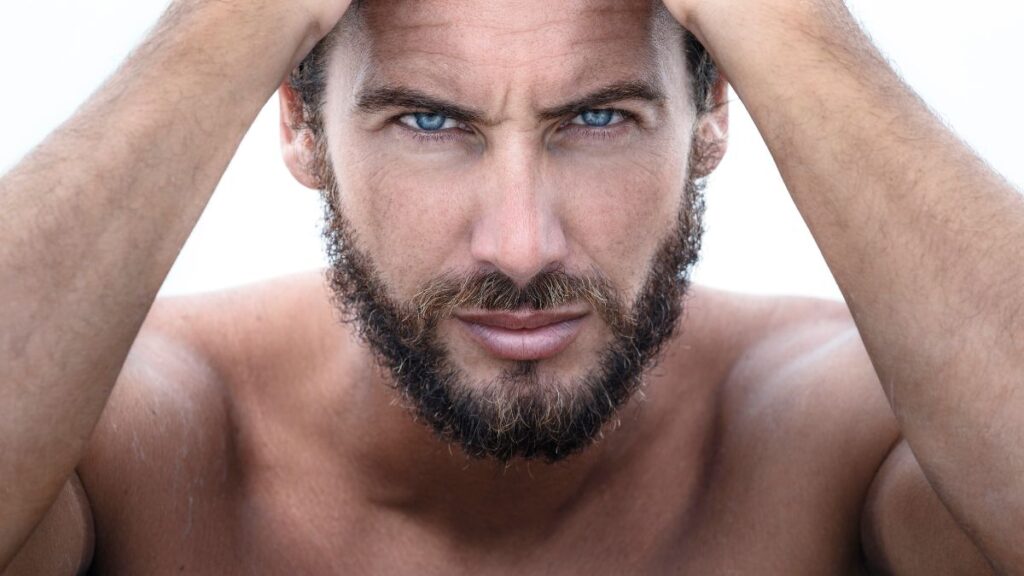

15 Attractive Qualities That Make A Man Stand Out From The Others

Certain qualities distinguish exceptional men from those who seek recognition, success, and material possessions. Whether it’s their confidence, integrity, or empathy, these traits leave a lasting…

15 Attractive Qualities That Make A Man Stand Out From The Others

Victoria Cornell helps women adopt a positive mindset even when the struggles of motherhood feel overwhelming. Victoria writes for multiple media outlets where she writes about, saving money, retirement, ways to reduce stress with mindset, manifesting, goal planning, productivity, and more.