Dreaming of retiring early? It’s not just wishful thinking. With careful planning and discipline, you can make it a reality. Retiring early is often a pipe dream for most, as it requires careful planning, discipline, and sacrifice, but the reward is well worth it! By implementing these tips and staying committed to your financial goals, you can achieve an early retirement and the retirement lifestyle you’ve always dreamed of. Start taking steps today to secure your financial future and enjoy the freedom of early retirement.

Start Saving Early

The sooner you start saving, the more time your money has to grow through compound interest. Even small contributions made consistently over time can accumulate into significant savings. Begin by setting aside a portion of your monthly income, no matter how small.

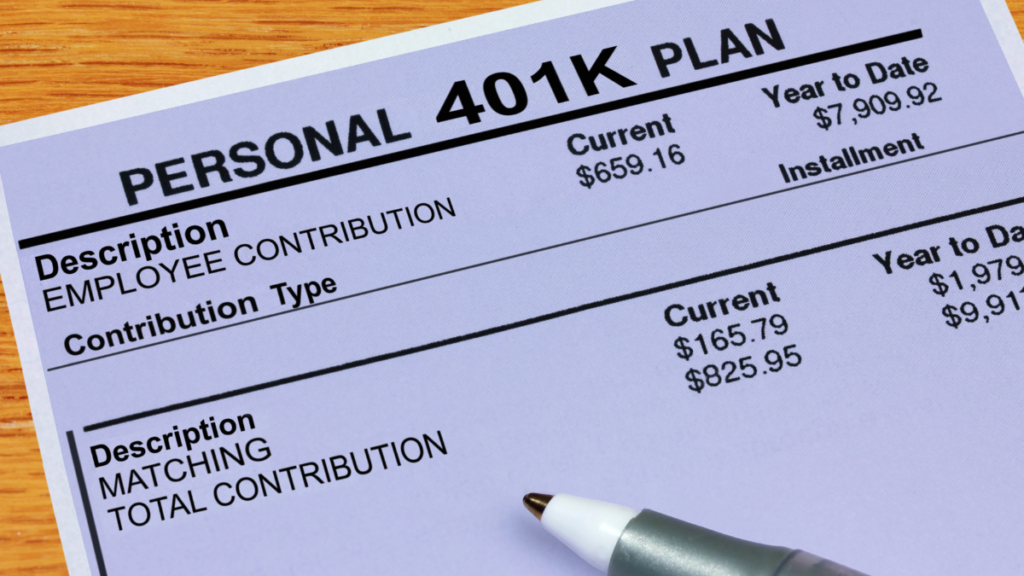

Maximize Retirement Accounts

Take advantage of employer-sponsored retirement plans like 401(k)s and Individual Retirement Accounts (IRAs). Contribute as much as possible, especially if your employer offers matching contributions—it’s essentially free money. Aim to contribute the maximum allowable amount to these accounts each year to maximize your retirement savings potential.

Live Below Your Means

Maintain a modest lifestyle and avoid unnecessary expenses. Differentiate between wants and needs, and prioritize saving over spending. Cutting back on luxuries now can greatly accelerate your path to early retirement. Look for ways to negotiate bills and expenses to stretch your dollars further.

Create a Budget

Track your income and expenses to identify areas where you can save. A detailed budget helps you stay accountable and ensures that your money is working toward your retirement goals. Set specific savings targets for each budget category to stay on track.

Invest Wisely

Diversify your investment portfolio to minimize risk and maximize returns. Consider a mix of stocks, bonds, real estate, and other assets based on your risk tolerance and financial goals. Regularly review and rebalance your portfolio to ensure it aligns with your objectives.

Avoid Debt

Debt can hinder your ability to save and invest for retirement. Pay off high-interest debts like credit cards and loans as soon as possible, and be mindful of taking on new debt. Prioritize debt repayment by focusing on high-interest accounts first while making minimum payments on others.

Increase Your Income

Look for opportunities to boost your income through side hustles, freelancing, or career advancement. Every additional dollar earned can accelerate your journey to early retirement. Invest in improving your skills or seeking promotions to increase your earning potential.

Plan for Healthcare Costs

Factor in healthcare expenses when calculating your retirement savings goal. Consider purchasing long-term care insurance or health savings accounts to cover potential medical expenses in retirement. Make sure to research Medicare options and supplemental insurance plans to ensure comprehensive coverage.

Cut Housing Costs

Downsize to a smaller home or consider relocating to a more affordable area. Lowering your housing expenses can free up more money for retirement savings. Explore alternative housing options like renting out spare rooms or downsizing to a tiny home to reduce housing costs further.

Embrace Frugality

Practice frugal habits like cooking at home, using coupons, and buying second-hand items. Small savings add up over time and can significantly impact your retirement ability. To stretch your budget further, look for creative ways to save money, such as carpooling or participating in clothing swaps.

Continuously Educate Yourself

Stay informed about personal finance and investment strategies. Use resources like books, podcasts, and online courses to expand your knowledge and make informed financial decisions. Attend workshops or seminars hosted by financial experts to stay up-to-date on the latest trends and best practices.

Plan for Inflation

Factor inflation into your retirement savings projections to ensure that your money maintains its purchasing power over time. Adjust your savings goals accordingly to account for rising costs. Consider investing in inflation-protected securities or diversified assets that historically outpace inflation rates.

Consider Downsizing

Evaluate your possessions and consider selling or donating items you no longer need. Downsizing can declutter your life and generate extra cash for retirement savings. Use the proceeds from downsizing to pay off debts or invest in income-generating assets to boost your retirement nest egg.

Invest in Yourself

Invest in skills and experiences to increase your earning potential or reduce expenses. Whether it’s further education, certifications, or learning new skills, investing in yourself pays dividends in the long run. Seek out mentors or career coaches to help you identify areas for growth and development.

Stay Disciplined

Stick to your retirement savings plan even when tempted to overspend or deviate from your goals. Stay focused on your long-term objectives, and remind yourself of the freedom that early retirement will bring. Regularly review your progress and adjust as needed to stay on track toward achieving your retirement goals.

15 Signs You’re Still Dealing With Unhealed Childhood Trauma

Recognizing the warning signs of unhealed trauma is crucial for both individuals and their loved ones. Unaddressed trauma can significantly impact one’s mental, emotional, and physical…

15 Signs You’re Still Dealing With Unhealed Childhood Trauma

15 Crucial Mistakes People Make Before Entering Retirement

Retirement marks a significant life transition, but the journey towards it requires careful planning and consideration. Unfortunately, many individuals overlook crucial aspects as they approach retirement…

15 Crucial Mistakes People Make Before Entering Retirement

15 Common Behaviors That Show Someone’s True Colors

Understanding someone’s true character can be challenging, as people often present themselves differently in various situations. However, certain behaviors can offer insights into a person’s genuine…

15 Common Behaviors That Show Someone’s True Colors

15 Things Boomers Had the Luxury of Affording But Millennials Can’t

As the economy continues to evolve, certain luxuries and amenities once considered standard have become increasingly out of reach for younger generations. Baby boomers, born between…

15 Things Boomers Had the Luxury of Affording But Millennials Can’t

15 Signs You’re In The Lower Class

Navigating socioeconomic status can be complex, but certain indicators may suggest that you’re part of the lower class. Understanding these signs can provide insight into financial…

15 Signs You’re In The Lower Class

Victoria Cornell helps women adopt a positive mindset even when the struggles of motherhood feel overwhelming. Victoria writes for multiple media outlets where she writes about, saving money, retirement, ways to reduce stress with mindset, manifesting, goal planning, productivity, and more.